Are you looking to improve your financial situation? Many people feel overwhelmed by debt, confused about investing, or unsure how to build lasting wealth. The world of personal finance can seem complex, but with the right guidance, you can take control of your money and build a secure future. This is where Cyclemoneyco comes in. We provide the tools, strategies, and insights you need to navigate your financial journey with confidence.

This comprehensive guide will explore the core principles of financial wellness championed by Cyclemoneyco. We will cover everything from smart budgeting and debt management to effective strategies for growing your income. Our goal is to empower you with practical knowledge so you can not only manage your money but also make it work for you. Let’s dive into how you can turn your cash cyclemoneyco around and achieve your financial goals.

Understanding the Cyclemoneyco Philosophy

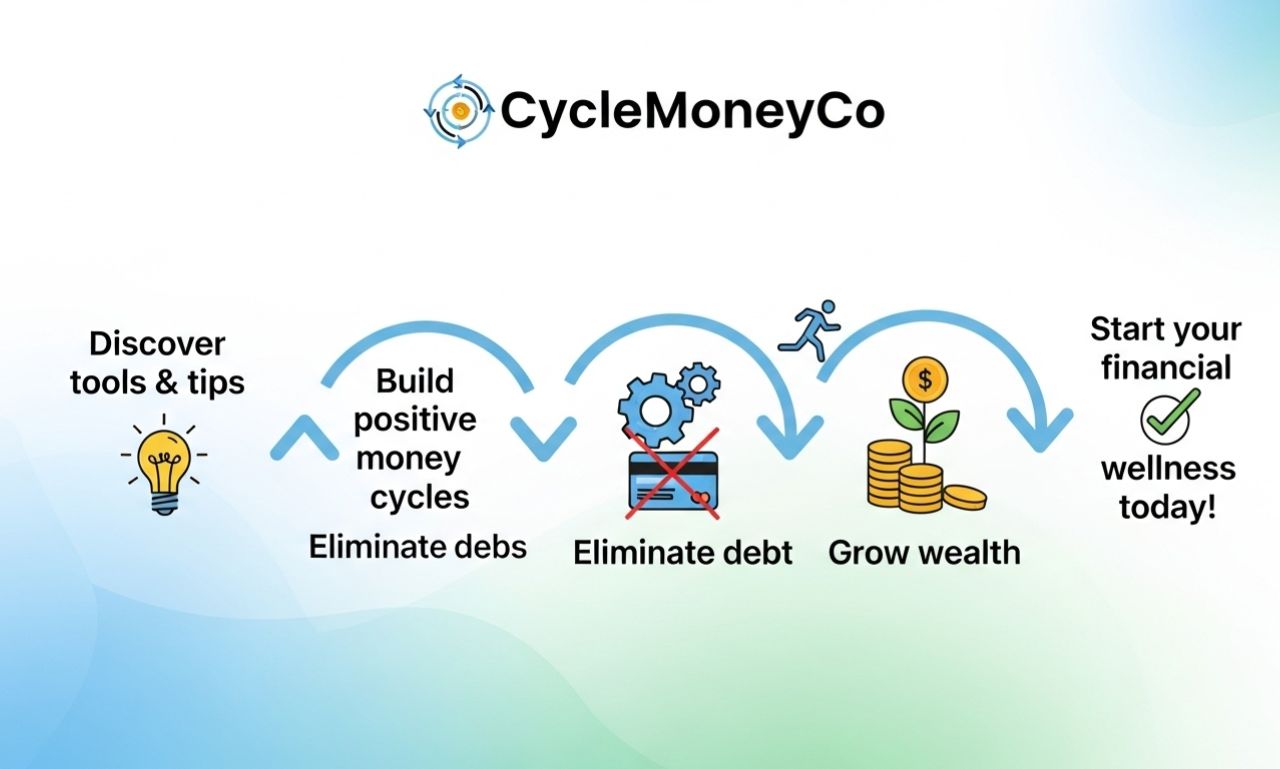

At its heart, the Cyclemoneyco approach is about creating positive financial cycles. Instead of living paycheck to paycheck or seeing your money disappear without a trace, we help you build systems that promote growth and stability. This involves understanding your cash flow, setting clear goals, and making intentional decisions that align with your long-term vision.

Breaking free from negative money habits is the first step. This could mean tackling high-interest debt that drains your income or curbing impulse spending that sabotages your budget. By replacing these habits with positive ones—like automating savings or investing consistently—you create a powerful momentum. The www cyclemoneyco platform is designed to support you at every stage of this transformation.

Key Principles of Financial Health

- Awareness: You can’t manage what you don’t measure. The first step is to get a clear picture of your income, expenses, assets, and liabilities.

- Intention: Every dollar you spend should have a purpose. We’ll show you how to create a budget that reflects your priorities.

- Action: Knowledge is only powerful when applied. We focus on actionable steps you can take today to improve your financial standing.

- Consistency: Building wealth is a marathon, not a sprint. Small, consistent actions over time lead to significant results.

Making Cash Cyclemoneyco: Strategies for Income Growth

A crucial part of financial health is maximizing your earning potential. While cutting expenses is important, there’s a limit to how much you can save. Increasing your income, however, has unlimited potential. Here are several strategies for making cash Cyclemoneyco style, from optimizing your current job to building new revenue streams.

Maximize Your Primary Income

Your main job is often your biggest asset. Before looking for side hustles, ensure you are maximizing your income from your primary career.

- Negotiate Your Salary: Many people leave money on the table by not negotiating their salary. Research industry standards for your role and experience level. Prepare a case that highlights your accomplishments and value to the company. A simple conversation could lead to a significant pay increase.

- Seek Promotions and Skill Development: Invest in yourself. Acquiring new skills, certifications, or advanced degrees can make you eligible for higher-paying positions within your company or industry. Look for opportunities to take on more responsibility and prove your worth.

- Excel in Your Role: High performers are often rewarded with bonuses, raises, and other opportunities. Focus on exceeding expectations in your current role to position yourself for financial advancement.

Develop Multiple Streams of Income

Relying on a single source of income can be risky. Building multiple streams of income provides a safety net and accelerates your wealth-building journey.

- Start a Side Hustle: The gig economy offers countless opportunities. Consider freelancing with skills you already have, such as writing, graphic design, or web development. You could also drive for a rideshare service, deliver food, or become a virtual assistant. The key is to find something that fits your schedule and skills.

- Monetize a Hobby: Do you love photography, baking, or crafting? Turn your passion into a profit center. You can sell your products on platforms like Etsy, offer your services locally, or teach others through workshops or online courses.

- Build Passive Income Streams: This is the ultimate goal for many. Passive income is money earned with minimal active effort. Examples include:

-

- Investing in Dividend Stocks: Companies pay you a portion of their profits just for owning their stock.

- Real Estate: Rental properties can provide a steady stream of monthly income.

- Creating Digital Products: Write an ebook, create an online course, or design templates. After the initial work, you can sell them indefinitely.

Check out our latest post Cyclemoneyco for a deep dive into building five different passive income streams from scratch.

Turn You Cash Cyclemoneyco Around: Budgeting and Debt Management

If you feel like your finances are spiraling out of control, it’s time to take decisive action. Learning to manage your cash flow and eliminate debt are foundational steps to financial freedom. Let’s explore how you can turn you cash Cyclemoneyco around with proven strategies.

The Power of a Purposeful Budget

A budget is not about restriction; it’s about freedom. It’s a plan that tells your money where to go, ensuring your spending aligns with your goals.

- Track Your Spending: For one month, track every single dollar you spend. Use an app, a spreadsheet, or a simple notebook. This will reveal where your money is actually going, often with surprising results.

- Choose a Budgeting Method: There are many popular methods. The 50/30/20 rule suggests allocating 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. A zero-based budget involves assigning every dollar a job, so your income minus expenses equals zero. Find the method that works best for you.

- Automate Your Savings: Pay yourself first. Set up automatic transfers from your checking account to your savings and investment accounts on payday. This ensures you’re consistently building wealth before you have a chance to spend the money.

A Smart Approach to Tackling Debt

High-interest debt, especially from credit cards, can be a major obstacle to financial progress. Creating a clear plan to pay it off is essential.

- The Debt Snowball Method: List your debts from smallest to largest, regardless of interest rate. Make minimum payments on all debts except the smallest one, which you attack with any extra money you have. Once that’s paid off, you roll the payment amount over to the next-smallest debt. This method provides quick wins and psychological momentum.

- The Debt Avalanche Method: List your debts from highest interest rate to lowest. Make minimum payments on all debts except the one with the highest interest rate. This method saves you the most money in interest over time, though it may take longer to get your first win.

Whichever method you choose, consistency is key. The sooner you eliminate high-interest debt, the more of your income you can divert toward wealth-building activities.

The World of Finance Latests: Cyclemoneyco Insights on Investing

Once you have your budget and debt under control, it’s time to start making your money work for you through investing. Investing can seem intimidating, but the principles are straightforward. The goal is to put your money into assets that have the potential to grow over time. For the world of finance latests cyclemoneyco has you covered with timely insights and timeless principles.

Getting Started with Investing

You don’t need a lot of money to start investing. Thanks to modern brokerage platforms, you can begin with as little as a few dollars.

- Define Your Goals and Risk Tolerance: Are you investing for retirement in 30 years or a down payment on a house in five years? Your timeline will influence your investment choices. Your risk tolerance—how you feel about market ups and downs—is also a critical factor.

- Understand Your Options:

-

- Stocks: Ownership in a single company. Higher risk, higher potential reward.

- Bonds: A loan to a government or corporation. Lower risk, lower potential return.

- Index Funds and ETFs: Baskets of stocks or bonds that track a market index (like the S&P 500). They offer instant diversification and are a great choice for beginners.

- Utilize Retirement Accounts: Take advantage of tax-advantaged retirement accounts like a 401(k) or an IRA. If your employer offers a 401(k) match, contribute at least enough to get the full match—it’s free money!

Long-Term Investing Principles

Successful investing is often about discipline and patience, not trying to time the market.

- Consistency is Key: Dollar-cost averaging—investing a fixed amount of money at regular intervals—is a powerful strategy. It reduces risk and ensures you’re consistently buying, whether the market is up or down.

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Spreading your investments across different asset classes, industries, and geographic regions helps mitigate risk.

- Think Long-Term: The stock market is volatile in the short term but has historically trended upward over the long term. Avoid making emotional decisions based on daily market news. Stay the course and trust your long-term plan. The Cyclemoneyco cash around philosophy emphasizes patience and a steady hand.

Stay Connected and Keep Learning

Your financial journey is an ongoing process of learning and adapting. The financial landscape is always changing, and staying informed is crucial for your long-term success. We are committed to providing you with the resources and support you need every step of the way.

We regularly publish new articles, guides, and tips to help you navigate your finances. Follow us to get the latest insights and strategies delivered directly to you. For any specific questions or personalized guidance, feel free to contact @cyclemoneyco on our social media platforms.

The path to financial wellness is within your reach. By applying the principles of awareness, intention, action, and consistency, you can build positive money cycles, eliminate debt, and grow your wealth. Start today by taking one small step. Track your spending, make an extra debt payment, or open an investment account. Your future self will thank you. Visit us at www cyclemoneyco to begin your journey.

Meta Title: CycleMoneyCo – Empowering Your Financial Wellness Journey

Meta Description: Discover tools & tips to build positive money cycles, eliminate debt, and grow wealth. Start your financial wellness today!News Update

News Update

News Update

News Update

News Update

Technology

Technology

Technology

Technology

Technology

Sport

Sport

Sport

Sport

Sport

Health

Health

Health

Health

Health

Crypto

Crypto

Crypto

Crypto

Crypto

Business

Business

Business

Business

Business

Kitchen

Kitchen

Kitchen

Kitchen

Kitchen

Art

Art

Art

Art

Art

Culture

Culture

Culture

Culture

Culture

Times

Times

Times

Times

Times